A huge number of individuals have been put jobless because of the Coronavirus pandemic. Families are battling to take care of their bills in light of the fact that their kind of revenue was suddenly cut off.

With the current pandemic, it’s a higher priority than any time to save every single cycle of cash you can during these intense and difficult occasions.

That is the reason we have compiled a broad rundown of things you can do to save a huge number of dollars this year and even bring in additional cash to help take care of the bills.

1. Paycheck Protection Program

Another program pointed toward assisting small businesses and self-employed people is the Paycheck Protection Program offered by the Small Business Association.

With this program, it’s conceivable to apply for a credit to help keep employees on the payroll. On the off chance that a credit recipient keeps all workers on the payroll for about two months and utilizes the loan money for finance, lease, mortgage interest, or utilities, the advance won’t need to be reimbursed.

2. Stimulus Payments

Under the recently instituted CARES Act, a huge number of families as of now have gotten a one-time payment of up to $1,200 per grown-up and $500 for every kid to assist shore with increasing their finances. Nonetheless, not every person is qualified for a stimulus payment.

The federal government has sent in excess of 88 million stimulus payments to Americans up until this point, with millions of additional payments in transit. Be that as it may, in the event that you fall into some unacceptable classification, there is a chance you may never get one.

A few groups of individuals don’t fit the bill for the “recovery rebates” that were part of the new government Coronavirus Aid, Relief, and Economic Security Act, or CARES Act.

The refunds are proposed to help individuals take care of bills and to support the general economy when the Covid pandemic has constrained the closure of work environments across the nation.

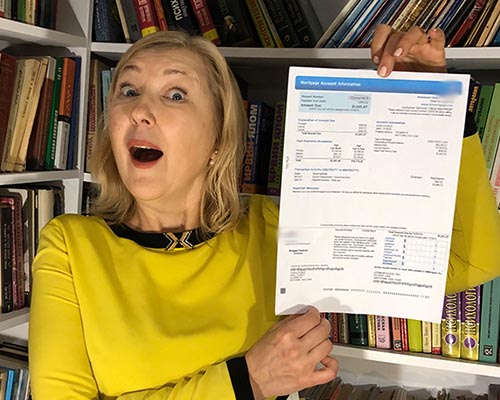

3. Get $3,600/year Off Your Mortgage With The Advantageous “RaTO” Program

Your Bank Doesn’t Want You Knowing This

This, unknown to many, is a splendid home refinance program called the Rate and Term Option (RaTO) that could profit a huge number of property holders and decrease their installments by as much as $3,600 every year! You could bet your bank isn’t too thrilled about losing such benefit and may secretly hope mortgage holders don’t discover before the guidelines change.

So while your home loan bank joyfully trusts that this program will end, specialists are making a cross country push and asking mortgage holders to exploit it. This program is presently accessible as of December, however, the standards could change soon. In any case, fortunately, once you’re in, you’re in. In the event that bringing down your installments or taking care of your home loan quicker would help you, it’s crucial you act and check whether RaTO is accessible for you to exploit.

How Do I Check If RaTO Could Cut Down My Mortgage Payments?

Stage 1: Click your state on the guide.

Stage 2: Use the FREE mortgage tool to check if RaTO is accessible to you. Tap Here and Enter Your Zip Code To Start >>

4. New Auto Insurance Policy

This is what auto insurance organizations don’t need you to know…and what a huge number of shoppers are rapidly finding out about their present collision protection plan:

In case you’re paying more than $63 every month for auto insurance, this auto insurance comparison tool can help you verify whether you’re overpaying in almost no time. This is something each driver should do like clockwork or so to guarantee that they are getting the best deal.

So help yourself out and do a brisk examination by rounding out a short form (around 4 minutes). This is a quick way you can begin saving money on your auto bills.

5. Get Paid To Go Shopping

With the stay-at-home orders across the country, numerous individuals are falling back on using services for the delivery of groceries. This carries a remarkable opportunity for individuals to make money with these services part-time or even full-time!

Shipt personal customers shop and deliver food and family unit basics. You have full control of your timetable with Shipt. Shipt expects customers to have a substantial driver’s license and admittance to a dependable vehicle, 1997 or more current.

Shipt pays weekly, and you’ll gain access to a supportive network of other Shipt customers. As indicated by Shipt, individual customers make a normal of $22 per 60 minutes, however, Glassdoor reports that Shipt personal customers make $11 to $14 every hour.

6. Clean Vehicle Rebate Program (CVRP)

Get up to $7,000 to buy or rent a new plug-in hybrid electric vehicle (PHEV), battery electric vehicle (BEV), or a fuel cell electric vehicle (FCEV).

CVRP offers vehicle refunds on a first-come, first-served premise and gets the cleanest vehicles out in California by giving purchaser discounts to diminish the initial expense of advanced innovations. Refunds are accessible to California occupants that meet income prerequisites and buy or rent a qualified vehicle.

7. Purchase in Bulk

One of the easiest things you can do to really begin setting aside cash is to purchase in mass! Retailers frequently give MUCH better deals on items, for example, paper towels, tissue, cleanser, and so on the off chance that you purchase in mass.

This may appear to be an obvious one, yet we regularly fail to remember how much cash we squander by not buying in mass.

8. Use Government Rebates To Get Solar Panels And Slash Your Energy Bills

Cautioning: Do not take pay your next energy bill until you read this…

This is the 1 straightforward truth your power organization doesn’t need you to know. There is another approach in 2020 that qualifies property holders who live in explicit zip codes to be qualified for $1,000’s of Government subsidizing to install solar panels. Has your power organization disclosed to you that? Obviously not. They trust property holders don’t find out about this splendid method to lessen your energy bill enormously!

At the point when mortgage holders check whether they qualify many are stunned that sponsorships and refunds can cover a ton of the expenses related to installation so it extraordinarily decreases the sum, you’ll need to pay.

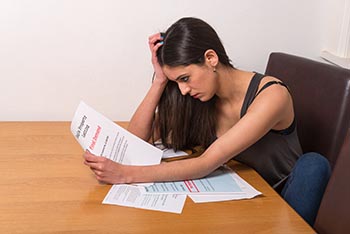

9. Utilize This Debt Payoff Plan

This is what credit card organizations don’t need you to know…and what a huge number of customers are rapidly learning out about paying off their debt:

On the off chance that you owe more than $15,000 in credit card debt, this demonstrated debt relief program may lessen the sum you owe. Customers could resolve their debts with definitely no advance required and pay them off at a quick speed. On the off chance that you’ve battled to pay your credit card debt, act now before your debt expands further.

10. Exploit Expanded Unemployment Relief

Did you lose your employment due to the Covid emergency, the CARES Act will probably help you monetarily. For instance, it:

Makes a transitory “Pandemic Unemployment Assistance” program through the finish of 2020 for laborers who regularly are not qualified for unemployment benefits but rather can’t work due to the Covid emergency. Such specialists incorporate the self-employed and independent contractors.

Gives a payment of an extra $600 every week to individuals who use unemployment insurance or Pandemic Unemployment Assistance, for as long as four months.

Gives an additional 13 weeks of unemployment benefits through the finish of 2020 for jobless individuals who still can’t seem to get another line of work when their state-provided unemployment benefits end.

11. Hang Out Your Laundry

The prospect of taking your laundry outside to hang and can be a turn-off for a few. In any case, imagine a scenario where you simply avoid the dryer and drape them to dry in your closet?. Save money by doing this!

12. Need a Patio? Think about Concrete Over Pavers

Building a porch can enhance your home, just as making charming open-air living space for you and your family. Yet, patios can come at an extraordinary expense.

At the point when we chose to add a porch to our home, we took a gander at the diverse surface alternatives cautiously. Although numerous exterior decorators would suggest pavers over cement in view of their durability over the long haul, we concluded that the cost investment funds were more essential to us.

Presently one thing to recall with concrete is that it WILL break in the end. In any case, in the event that you have a good concrete group, it should be prepared right where the breaks are negligible. So we hope to see breaks, however are confident that it will be insignificant.

13. Understudy Loan Repayment Assistance

In the event that you have governmentally claimed understudy loans, you will have the option to concede installments for six months, through the finish of September — penalty-free. This applies to both the principal and interest you owe on such credits.

Your manager may likewise assist you with reimbursing your loans. The CARES Act permits businesses to offer an understudy loan reimbursement advantage to employees on a tax-free premise. Under this plan, bosses can contribute up to $5,250 toward a worker’s understudy loans or educational costs like tuition costs and books this year.

14. Drop Unused Subscriptions

It’s simpler than any time in recent memory to pile up month to month membership bills since numerous items and administrations these days offer month to month plans. Yet, the issue with those is that you join and fail to remember. Or then again you get “cancel remorse” and keep memberships that you truly don’t utilize.

Go through your bank and financial records and survey your memberships right away!

15. Dinner Plan

Consider making weekly feast arrangements ahead of time to save a great deal on food. At the point when you plan your suppers out, you can resist the enticement of spending cash on take-out or fast food. You can likewise design a more beneficial eating routine this way as well!

You don’t have to purchase a cookbook by the same token. Much appreciation to the web, there are TONS of free recipes on the web. Ever heard about Pinterest? Check it out!

16. Veterans Get a Generous Discount at Lowes

All active military and veterans are qualified to get a 10% discount on all in-store buys at Lowe’s.

To make it far superior, Lowe’s stretches out this proposal to their mates! Need new devices? What about new apparatuses? Lowe’s conveys an assortment of things, so exploit this incredible discount!